2020

This year, our community endured extraordinary loss, yet exhibited overwhelming resilience and strength of common purpose. COVID-19 certainly affected our health and finances, but it also fundamentally changed the way we live and affected our economy and our society in long-lasting ways. One thing we

learned through this experience is just how important a safe, quality, and affordable home is for every person living in New Jersey. Quality of life starts at home. This reality is reflected in our state’s policy priorities. As we move from response to recovery, New Jersey Housing and Mortgage Finance is truly proud

to share in the Murphy Administration’s partnership with communities and residents to achieve a comprehensive and equitable recovery.

Amidst the challenges of the pandemic, NJHMFA has taken many steps to preserve core agency functions, ensuring the continued development and preservation of vital housing resources during an unexpected housing market boom, while making additional programs and funding available to assist the

many New Jersey residents in need.

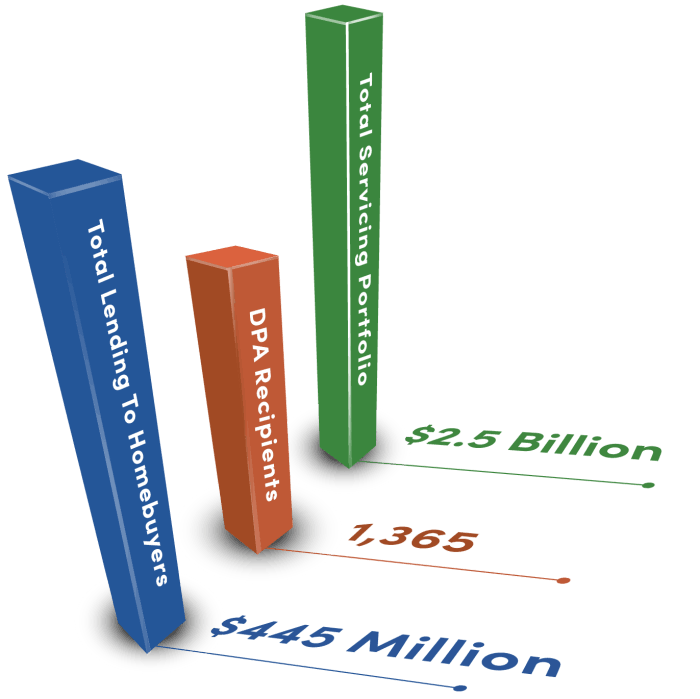

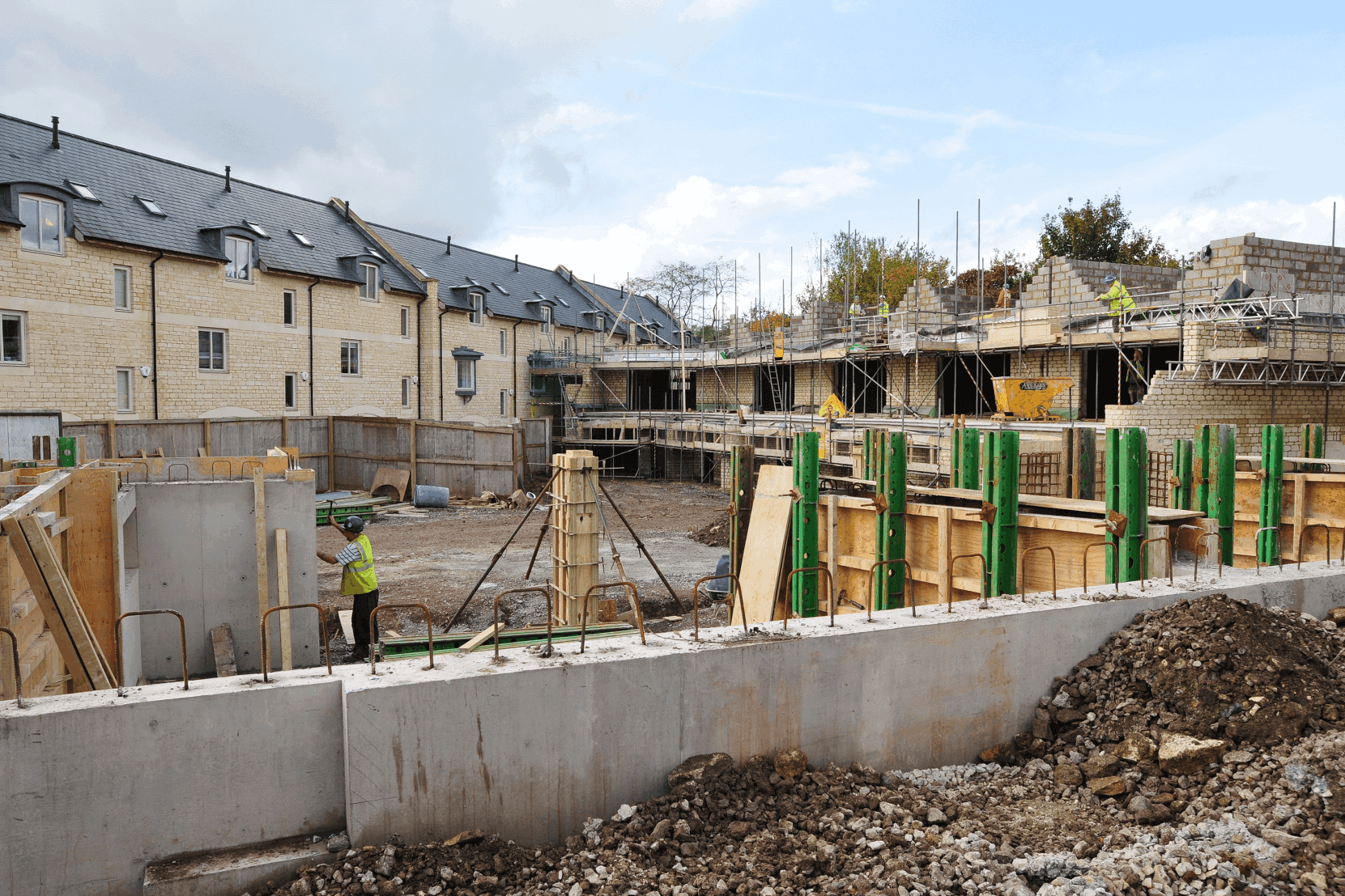

Clear bright spots for NJHMFA this year have included increases in Low Income Housing Tax Credit (LIHTC) awards and the statewide expansion of our $10,000 Down Payment Assistance (DPA) program. These programmatic areas have not only persisted despite the challenges that arose during the pandemic– they’ve thrived. Our multi-family division awarded over $27 million in annual 9% federal LIHTC in 2020. These highly competitive tax credits joined with more than $254 million in private investment to create 21 developments valued at over $550 million. Cumulatively, this resulted in more than 1,300 new apartments for families, seniors, and residents with special needs. The Special Needs Housing Partnership Loan Program also assured many of these properties contained supportive housing for persons with developmental disabilities, promoting community integration and individual independence. Our single-family programs have also advanced. The DPA program has expanded statewide, realizing a 326% growth in volume since the start of the Murphy administration while achieving broader scope and greater equity. Each new housing unit -each home- produced

through these programs represents an incremental step toward a stronger

and fairer New Jersey.

Additionally, NJHMFA’s first-of-its-kind Hospital Partnership Subsidy Program

is receiving national attention for its innovative creation of high-quality and specialized affordable housing through strategic financing and development partnerships with anchor institution hospitals. In addition to continuing to develop its own project pipeline and expand the breadth of existing interventions, NJHMFA is now advising state and hospital leaders across the country who are looking to replicate the program. As public awareness of the relationship between health

and housing continues to grow, this program has proven both timely and effective.

When crisis hit, not only did NJHMFA not slow down, it moved rapidly to increase its programmatic offerings. In March 2020, the Foreclosure Mediation Assistance Program (FMAP) was expanded to include pre-foreclosure counseling, offering early assistance to help homeowners avoid potential foreclosure. Simultaneously, counseling was made available to struggling renters to empower them to seek

fair outcomes. FMAP’s expansion allowed NJHMFA to provide greater service to New Jersey’s neediest families. Financial assistance was also made available to support struggling tenants and the small landlords in whose properties they reside. Now, as the year draws to a close, NJHMFA is rapidly developing a

cadre of new programs that will provide direct financial support to many households in need.

As we reflect on the tumult of the past year, we are truly thankful for the dedicated counsel and support we receive from the members of the NJHMFA board and the New Jersey Department of Community Affairs, and the partnership we enjoy with the many and diverse developers, lenders, housing authorities,

non-profits, advocates, and public officials who help us achieve our mission. Continuing to preserve and promote access to affordable housing and homeownership throughout New Jersey is critical to the future of our state.

We look back with pride on all that has been done to weather 2020 and

look forward to helping our shared home, New Jersey, thrive in 2021.